Latest News

15 October 2018

The Risks of Underinsurance

Have the recent storms got you thinking about your level of insurance cover and if the wild weather will leave you out in the cold?

Let's talk!

Now, I’ll be the first to admit that insurance is not an appealing subject to say the least.

But have you ever thought about the amount of insurance you need? Underinsurance is a thing and you're considered underinsured if your policy covers less than 90% of the total expenses in the occurrence of a loss (ASIC definition on MoneySmart.gov.au).

It can be tricky understanding whether you are underinsured or not, especially if you are fresh out of home and haven’t had to ‘adult’ like this before!

You’ll probably find yourself asking "What type of insurance do I need?", "Why do I need it?", and "Is it worth it?".

The frightening thing is that underinsurance can apply to anything from loan protection to any policy that involved assets. If these are undervalued, it means the underinsured would be subject to financial loss, even in the event of a claim. For example, let's say you insure your home for a lesser value than it's worth. If a natural disasater were to sweep through and cause damage, your insurer may have the authority to reduce the payout to the relative level of underinsurance. Unfortunately, the payout figure will be significantly less than that needed to resume the previous standard of living.

Don’t let it be too late to consider insurance and to update your policy. According to the Independent Financial Advisor (2016), for a developed nation Australia is one of the most financially illiterate countries! That's pretty alarming, right?

|

|

|

|

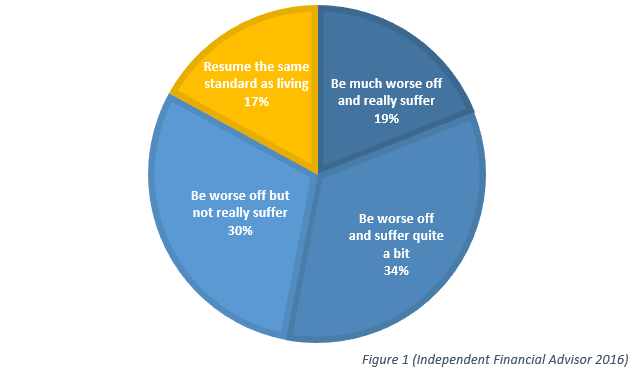

Only 17% of home owners/renters are adequately insured and the remaining 83% would not resume the same standard of living. |

How can I be underinsured?

We can minimise the threat of underinsurance by first understanding the factors that contribute to this risk.

These include but are not limited to the following:

- You have gradually accumulated possessions. This can include purchasing new appliances, televisions and other items. Calculate the sum of the items in your room for example, you might be surprised at the total!

- You’ve moved out of your childhood home and into your own pad and have opted for the best insurance you can afford. Moving outta home can be both scary and exciting! Ease that stress and get your home and contents covered.

- You’ve made a rash decision on the premium you wanna pay without considering the value of your assets. Let’s face it, insurance has a reputation of being a perceived a BIG effort but that’s not the case at all.

Don't cut the coverage, cut the risks

It is a good idea to enquire about potential factors exposed to you and your contents, especially with bushfire season looming.

Here at Coastline, we make it easy for our members to have access to insurance services so that when the unexpected happens, you’re covered!

We can help you get back on your feet quickly. All we need is details regarding the assets and/or belongings you'd like to insure!

One last message from us would be to NOT undervalue the replacement costs of your assests. The golden rule is to assume the worst possible case can happen and cover yourself for that.

Come in, have a chat and a coffee and let us do the hard work for you!

Or, you can grab a quote online by visiting our website and selecting your desired insurance.