Latest News

07 May 2018

Do you suffer from bill stress?

#BillStress #BillSmoothing #Budgeting #BudgetWise

Nearly one in three Australians is suffering from significant financial stress according to a research report conducted by CoreData in 2017. Living costs are rising, wage growth is slowing, and families are being placed under increased financial strain. The Australian Bureau of Statistics released figures in February showing that the cost of electricity alone rose by 12.4 per cent over the year. Add a baby or unexpected bill, remove a wage or income, and things can quickly get out of control.

The psychological burden of stress can have a physical effect on the body, causing sleep loss and lowered immunity. It can lead to anti-social behaviour, relationship conflict and breakdown, isolation and symptoms of depression. This problem affects all socio-economic groups.

If you are living pay-cheque to pay-cheque, struggling to pay off debt or just finding it hard to get ahead, you are not alone.

One of the toughest parts of budgeting is what to do when a significant number of bills all arrive at the same time. Working out your annual expenses is the easy bit, having enough cash ready to go when multiple bills come in all at once is the ongoing challenge.

At Coastline we appreciate how difficult it is to manage a lumpy bill cycle and stay in control of your finances, which is why we would like to introduce you to the concept of bill-smoothing and Budget Wise – an account that actually helps pay your bills and manage your personal finances.

In small business there are many cash flow smoothing products that allow businesses to pay expenses in accordance with their income. These tools allow businesses to manage their cash flow more efficiently which helps ensure their long term survival.

Wouldn’t it be great if we could access a similar tool to manage our own personal finances?

Unlike a business, most people have a regular income i.e. their wage/salary, but with limited options available for individuals to regulate their bill payments, it’s not surprising that money is the leading cause of stress.

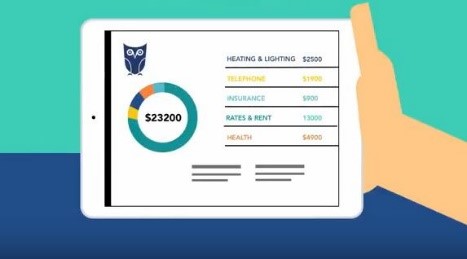

Budget Wise helps solve a common problem – it removes the stress associated with paying every day bills. By setting up a Budget Wise agreement with Coastline, you enter all your bills for the year – such as rent, electricity, gym memberships, childcare, mobile etc. The total amount of these bills is then divided by the number of pays you receive in this same period. Budget Wise will then determine a regular repayment schedule. As long as you make these regular repayments each time when your wage comes in, Budget Wise will ensure all of your bills (within the agreement) are paid for by their due date.

This simple cash flow smoothing means you can say goodbye to bill stress and get back to doing the things you enjoy most.

Make life easy. Ask for Budget Wise today and get some bill smoothing into your life.