Latest News

22 November 2018

OSKO and BPAY explained

Have you ever been out for dinner with friends and had to pay the bill because the restaurant doesn't split bills...Then had to wait days for their transferred money to come through to you?

Say goodbye to waiting and hello to Osko!

OSKO

Osko by BPAY is a simple and instantaneous platform for sending secure payments 24/7 through to friends, family and even small businesses. It forms part of the New Payments Platform (NPP), which is the fresh-faced payments infrastructure that allows for fast payments.

As its name suggests, Osko is managed by BPAY and is quickly transforming and becoming the main way in which Australians pay each other. In under a minute you can send money to another person within Coastline or to anyone in an Osko participating financial institution.

But how do I know that the funds I’m sending are going to the correct person?

You can either use the tradition BSB and Account Number transfer method or the user can set up a PayID.

So, forget the headache of remembering bank details! PayID means you can be paid or make payments using a registered mobile number, email address or ABN – easy as!

You can even confirm the payment before it is processed as the name of the person that owns the PayID you enter will appear automatically. All you have to do is confirm it’s the right person.

Another reason why so many Aussies are embracing Osko is that you get 280 characters to describe what the payment is for! And this doesn’t have to be limited words either; throw some emojis in there for bit of fun. ![]()

![]()

![]()

How safe & secure is Osko?

Relax. Piggybacking off BPAY’s secure reputation and because Osko is implemented using your financial institution's own security standards means it’s super safe and secure.

BPAY

Yes, Osko is handy but it’s not suitable for every type of payment. Remember those pesky bills we get each month? Well, most of you have probably already heard of BPAY and this allows Australians to transfer bill payments securely with ease!

According to research conducted in May, BPAY remains an Aussie icon when it comes to making easy bill payments for all Australians (BPAY, 2018).

- On average people pay 5 or 6 bills a month, and around 60% of Australians pay those bills using BPAY; and

- 88% of Australians recognise the iconic BPAY logo, as it’s on nearly every major bill in the country and in almost every internet banking platform.

So, it come as no surprise that the benefits of BPAY continue to attract Australians to its service.

BPAY allows for:

- Easy way to pay bills;

- Payments made in banking business hours are marked as paid on that day; and

- The ability to receive bills online through Internet or mobile banking with BPAY View.

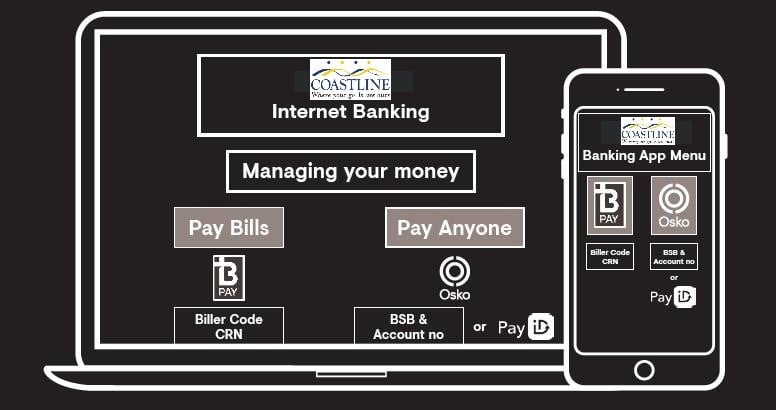

BPAY payments can be made through Coastline's Internet Banking or our MyCoast App as well as in Branch with one of our Member Service Advisors.

“Our customers have let us know they prefer to pay bills within the security of their banking environment and…as a result, over 1.5 million BPAY payments are made per day worth well over $1.5 billion, all within the safety of a customer’s internet or mobile banking.”

- Keith Brown (BPAY Group’s General Manager of Product, Scheme & Business Development)

References:

(BPAY, 2018) https://www.bpay.com.au/BPay/media/BPAYMediaGallery/

Image from: www.bpaybanter.com.au (with modifications.)