Online Banking

Your guide to simple, secure online banking -

personal, business, and community.

Banking online should be easy, safe, and stress-free - whether it’s for managing your personal accounts, running your business, or organising finances for a community group. Coastline Bank’s online services are designed to give you full control over your money, anytime and anywhere.

Here, you’ll find step-by-step guides to help you set up and navigate online banking, explore the features of the MyCOAST Mobile Banking App, and learn more about convenient payment services such as Confirmation of Payee, PayTo, and Osko. You’ll also find FAQs that answer common questions, plus guidance on how to pay bills, transfer funds, manage recurring payments, and even handle multiple transactions at once for your business or organisation.

With clear instructions, practical tips, and secure processes, managing your money online has never been simpler - giving you more time to focus on what matters most.

Personal Banking

Find helpful guides, FAQs, and tips for personal online banking.

Business Batch Banking

Guides, FAQs, and tips for business, community, and body corporate banking.

MyCOAST Mobile Banking App

Everything you need to start and manage banking on-the-go.

Payment Services

Everything you need to know about our payment services: CoP, PayTo and Osko.

Personal Banking

Banking online with Coastline is simple, secure, and designed to fit your lifestyle. In this section, you’ll find everything you need to manage your personal accounts confidently - from checking balances and transferring funds to paying bills and managing your cards.

We’ve included step-by-step guides and FAQs to make it easy for you to:

- Log in and set up your password securely

- Transfer funds, schedule payments, and use BPAY or PayTo

- Activate and manage your cards, including PIN updates

- Access account statements, year-to-date interest summaries, and savings tools

- Set up alerts, manage security settings, and update your personal details

Whether you’re on desktop or mobile, these resources help you bank online with confidence, answer common questions, and show you exactly how to make the most of Coastline Bank’s digital services.

Personal Banking FAQs

You’ll receive an initial password from Coastline Bank. Visit digital.coastline.com.au, enter your customer number and password, then follow the prompts to set a new secure password.

You’ll receive an initial password from Coastline Bank. Visit digital.coastline.com.au, enter your customer number and password, then follow the prompts to set a new secure password.

Click the “Reset here” link on the login page. Answer your security questions or contact Customer Support, then follow the prompts to set a new password with Two-Factor Authentication (2FA).

After logging in, go to ‘Accounts’ > ‘My Accounts’ and select your account to view balances, transactions, and additional functions like statements and savings goals.

Use the ‘Pay’ section to transfer funds internally, to other Coastline accounts, or externally via PayID, BPAY, or international payments. You can also schedule payments in advance.

- Internal transfers: $1,000,000/day

- External transfers: $10,000/day

- BPAY payments: $10,000/day

- International payments: $7,500/day

- Under 18s: $500/day

Limits may change; contact us for higher limits.

Go to the ‘Cards’ section to activate your card, update your PIN, or add it to Apple/Google Wallet. Note it may take up to an hour after activation to appear in wallets.

Coastline Bank uses Two-Factor Authentication (SMS or VIP Token/VIP Access App), secure passwords, and monitored login history to protect your accounts.

In the ‘Alerts/Notifications’ section, you can view, set up, and manage alerts for account activity, payments, and security notifications.

Go to ‘Settings’ > ‘My Details’ to update your personal information, contact details, and linked devices. Keeping details up to date ensures you receive important alerts and updates.

To open a Budget Wise account, you must be a Coastline Bank customer, 18 years or older, and not be declared bankrupt. If you’re not a customer yet, it’s free to join when you open your Budget Wise account.

Step 1: Nominate your bills – Choose the bills you want managed, such as loans, utilities, school fees, or vehicle registrations. You’ll also sign a 12-month deposit agreement so payments are spread evenly throughout the year.

Step 2: Get your regular deposit amount – Coastline Bank calculates your total bills, adds a 10% buffer for variable costs, and divides this by your number of paydays to set your regular deposit.

Step 3: Activate your account – Make an initial deposit to activate, then set up a scheduled transfer to fund your Budget Wise account each payday.

Step 4: Submit your bills – Send your bills via email or to a branch at least 7 days before they’re due. Coastline Bank will pay them directly from your Budget Wise account.

Ready to get started? Apply for your Budget Wise account here and enjoy peace of mind knowing your bills are organised and paid on time.

Business Batch Banking

Coastline Bank’s Business Batch Banking makes managing multiple payments simple, efficient, and secure. Whether you’re paying staff, suppliers, or recurring invoices, Batch Banking allows you to process up to 500 transactions in a single batch - and if you need to make more, you can easily create additional batches.

There are two ways to create batches:

- Manual Batches – Enter transactions by hand, ideal for regular or one-off payments. Using templates, you can pre-fill recurring payments like payroll or supplier invoices, making batch creation faster and easier to reconcile.

- Cemtex (ABA) Upload Batches – Upload a batch file from your accounting software (such as MYOB or Xero) to streamline the payment process. Templates ensure consistent setup and help you track and reconcile payments efficiently.

Both methods offer multi-signatory approvals, transaction history exports, and the ability to review and manage failed payments. Choose the method that suits your business needs and follow the step-by-step guides to get started.

Business Batch Banking FAQs

Log in to Online Banking, then go to the Batch Banking section and expand the menu. If you need help logging in, refer to the Guide to Online Banking or contact Coastline Bank Customer Support on 1300 361 066.

Log in to Online Banking, then go to the Batch Banking section and expand the menu. If you need help logging in, refer to the Guide to Online Banking or contact Coastline Bank Customer Support on 1300 361 066.

Batch Banking allows you to manage multiple payments efficiently. You can process up to 500 transactions in a single batch and easily create additional batches if needed. It is suitable for payroll, supplier payments, recurring bills, and other regular payments.

Batch Banking makes managing your business payments simple and efficient. It’s especially useful for:

- 2 to sign accounts: Required for accounts with multi-signatory approval.

- Multiple payments: Process hundreds of transactions in one batch.

- Recurring payments: Templates streamline regular payments like payroll or supplier invoices.

Manual Batch Banking FAQs

A Manual Batch is a way to enter and process multiple payments directly in Online Banking without uploading a file. This option is ideal for smaller organisations, clubs, or societies that may not have complex accounting software or large volumes of payments.

With a Manual Batch, you can:

- Create a template for recurring payments, like staff wages or supplier invoices.

- Add transactions one by one using internal transfers, external transfers, or BPAYs.

- Easily review and process the batch in a single step.

It’s a simple, flexible way for smaller groups to manage their payments efficiently while keeping control over each transaction.

A Manual Batch is a way to enter and process multiple payments directly in Online Banking without uploading a file. This option is ideal for smaller organisations, clubs, or societies that may not have complex accounting software or large volumes of payments.

With a Manual Batch, you can:

- Create a template for recurring payments, like staff wages or supplier invoices.

- Add transactions one by one using internal transfers, external transfers, or BPAYs.

- Easily review and process the batch in a single step.

It’s a simple, flexible way for smaller groups to manage their payments efficiently while keeping control over each transaction.

A template is a pre-set batch setup that includes your regular transactions. It saves time by pre-filling details for recurring payments, making batch creation faster and easier to reconcile.

Templates are automatically saved—there is no separate “Save” button.

Click the edit button or the three dots (ellipsis) next to the template or transaction you want to change.

The description field is free-form and does not retain previous text. Scheduled payments will maintain the description, but manual templates require you to re-enter the description if needed.

Batches can only be created through Online Banking, using a template you have previously created.

You can approve a batch either through Online Banking or via the MyCOAST Mobile Banking App. Multi-signatory batches will notify the other signatories when action is required.

ABA File (Cemtex Upload Batches) FAQs

An ABA file is a standard batch payment file generated by accounting software like MYOB or Xero. It contains multiple payment instructions that can be uploaded directly into Coastline Bank’s Batch Banking. ABA files are ideal for larger businesses or organisations that process many payments regularly, such as payroll or supplier payments, and want to streamline the process by uploading transactions in bulk rather than entering them manually.

An ABA file is a standard batch payment file generated by accounting software like MYOB or Xero. It contains multiple payment instructions that can be uploaded directly into Coastline Bank’s Batch Banking. ABA files are ideal for larger businesses or organisations that process many payments regularly, such as payroll or supplier payments, and want to streamline the process by uploading transactions in bulk rather than entering them manually.

Generate the ABA file from your accounting software (MYOB or Xero). Then upload it into Batch Banking using an Upload File Batch template.

Failures can occur for several reasons:

- Incorrect file format

- Incorrect BSB or account details

- Incorrect account length or characters

- Incorrect name formatting

Refer to section 10 of the ABA batch guide for troubleshooting.For ABA files, transactions are not visible until after the batch is created. Templates only set up the structure; the transactions are imported once the batch is uploaded.

No, a batch cannot be rerun. If a batch fails or needs changes, you must create a new batch.

Approval is the same as for Manual Batches: through Online Banking or the MyCOAST Mobile Banking App. For multi-signatory accounts, other signatories will be notified and must approve as required.

How to get started

If you need your login details, please get in touch with our friendly team on 1300 361 066 or visit your local Coastline Bank branch.

Download the MyCOAST app from the Apple Store or Google Play.

Enter your customer number and password.

Start banking on your phone and access your accounts at any time.

How to transfer money with MyCOAST

- Log in to the MyCOAST app and select the ‘Transfer’ menu.

- Select ‘Between Accounts’ from the menu.

- Use the pencil icon to select from account and to account.

- Select the account you would like the funds to be deducted from.

- Enter the amount you want to transfer and, if needed, a reference and/or description.

- Select ‘Now’ to make the payment immediately, ‘Later’ to schedule it for a later date, or ‘Recurring’ if you would like this payment to be ongoing regularly.

- Select ‘Continue’ to review the details. You can go back and edit if you need to.

- Select ‘Complete transfer’ to finalise the transfer.

How to transfer money to another person

- Log in to the MyCOAST app and select the ‘Transfer’ menu.

- Select ‘To someone else’ from the menu.

- Select payee, choose from your ‘Recents’ or ‘Favourites’ lists, or select ‘Create’ to set up a new payee.

- If creating a new payee, select the payment type

- If the payee uses Osko®, you can transfer funds using their PayID, such as a phone number, email, ABN, or organisation ID.

- If the payee doesn’t have Osko®, choose ‘BSB / account number’ to input the BSB, Account Number, and Name.

Note: When transferring funds to another Coastline Bank customer, use the BSB 704-189.

- Select the account you would like the funds to be deducted from.

- Enter the amount you want to transfer and, if needed, a reference and/or description.

- Select ‘Now’ to make the payment immediately, ‘Later’ to schedule it for a later date, or ‘Recurring’ if you would like this payment to be ongoing regularly.

- Select ‘Continue’ to review the details. You can go back and edit if you need to.

- Select ‘Complete transfer’ to finalise the transfer.

Make an international transfer with MyCOAST

To make an international transfer:

- Log into the MyCOAST Mobile Banking app.

- Tap the menu (the 3-line icon) in the top right corner of your screen.

- Select ‘Pay’ and then ‘International Transfers’.

- Select ‘OK, let’s go’ and then ‘Create’.

Select payee, choose from your ‘Recents’ or ‘Favourites’ lists, or select ‘Create’ to set up a new payee.

- Select the country you want to transfer to.

- Fill out payee details and then ‘Continue’.

- Use the search feature to fill out the receiving bank’s details or input manually, then ‘Continue’.

- Choose the receiver’s preferred currency.

- Enter the amount you wish to transfer, either in AUD or the foreign currency.

- Click ‘Request Quote’ to see the exchange rate.

- If you are happy with the exchange rate, review the details and proceed with the transfer.

Reset your MyCOAST password

If you’ve forgotten your password, call us on 1300 361 066 or visit your nearest Coastline Bank branch during business hours. We’ll be happy to assist you with the reset process.

If you’ve entered an incorrect password three times in a single day, your internet and mobile banking will be temporarily blocked until midnight. After midnight, the block will be automatically lifted, and you can try again. If you cannot wait until midnight, please call us on 1300 361 066

How to change your PIN using the MyCOAST App

- Log in to the app

- Select the ‘Cards’ menu at the bottom of the screen

- Select ‘Change card PIN’

- Enter your new PIN and confirm it by entering the new PIN again

How to report a lost or stolen card using the MYCOAST App

- Log in to the app

- Select the ‘Cards’ menu at the bottom of the screen

- Choose the card you wish to report

- Select ‘Report lost or stolen card’

- Select ‘Lost’ or ‘Stolen’ by clicking on the relevant button, then click proceed

Payment Services

Managing your money is easier than ever with Coastline Bank’s modern payment options. Whether it’s sending funds instantly, paying regularly, or setting up secure automated payments, our COP, PayTo and Osko features give you the flexibility, speed, and control to handle your transactions your way.

What would you like to learn more about?

Confirmation of Payee (CoP)

Protecting your payments

At Coastline Bank, your security is our priority. Confirmation of Payee (CoP) is a new feature that helps protect you from scams, fraud, and mistaken payments by checking the details you enter against the recipient’s bank records. You’ll see the result before the payment goes through, giving you peace of mind and control.

CoP helps you:

- Avoid scams

- Prevent mistaken payments

- Feel more confident about your money

COP by Australian Payments Plus

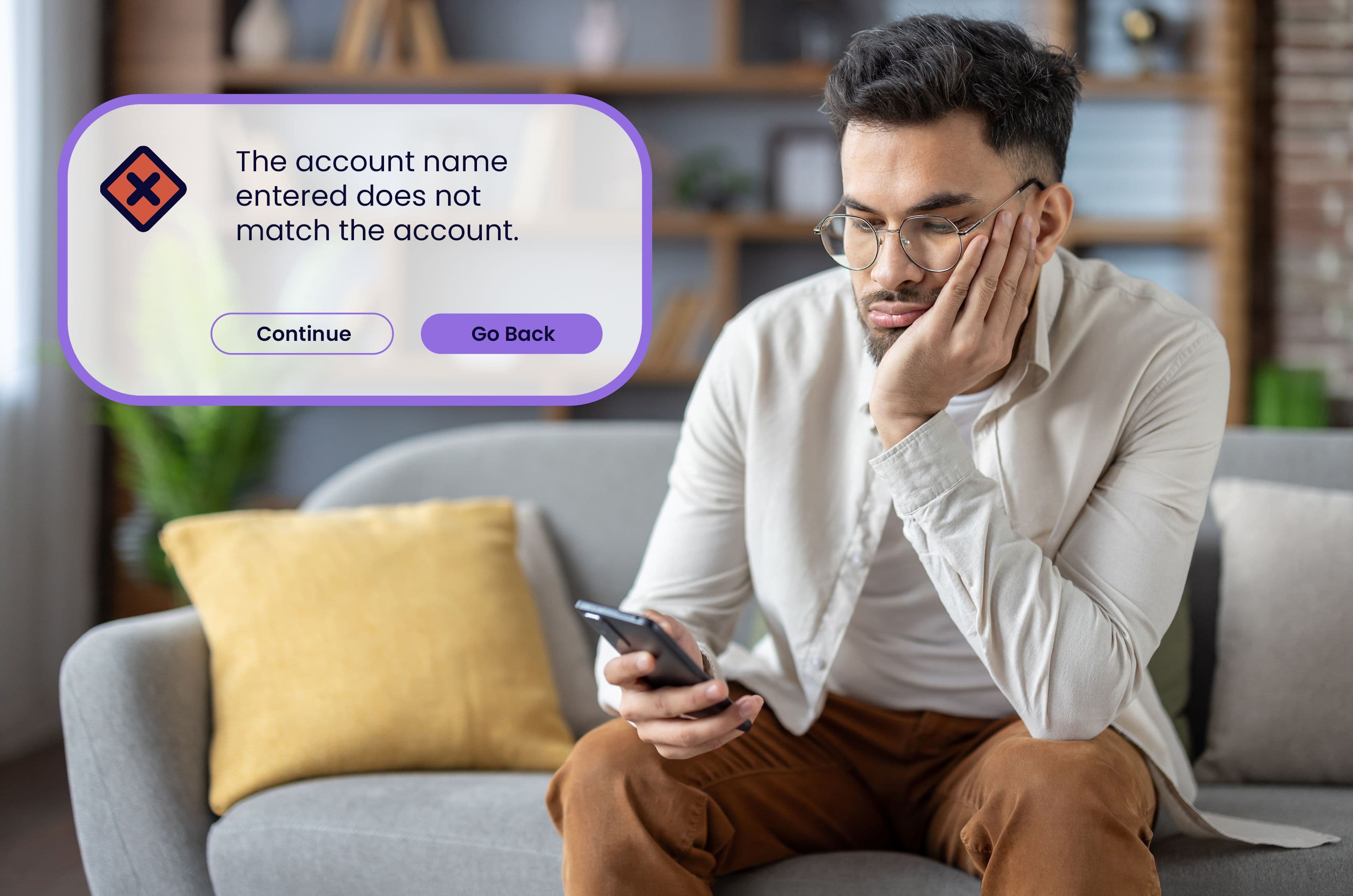

- When you add or update a payee’s BSB and account number, CoP checks the details against the recipient’s bank.

- You’ll see one of four match outcomes:

- Match – details exactly match the recipient’s bank record

- Close match – very similar, but not identical

- No match – details don’t match

- Error – something went wrong with the check

3. You decide whether to proceed, double-check, or cancel the payment.

- Business or government accounts – the account name is always shown.

- Personal accounts – the name is shown only for a match or close match to protect privacy.

- No setup needed – CoP is automatically available in your Online Banking and MyCOAST Mobile Banking App whenever you make a first-time payment or update a payee.

- You’re always in control – CoP won’t stop you from making a payment. If something doesn’t look right, it’s a chance to pause and double-check.

About Confirmation of Payee

Confirmation of Payee is an industry-wide service that adds a layer of protection for payments to a BSB and account number. It checks the account name, BSB and account number you’ve entered against the details held by the recipient’s bank and lets you know whether it’s a match. This can help you make informed decisions before you make a payment, reducing the risk of scams and mistaken payments. Confirmation of Payee is an initiative of Australian Payments Plus, the same organisation that also provides trusted payment services like BPAY®, Osko®, eftpos®, PayID® and PayTo®.

Confirmation of Payee is an industry-wide service that adds a layer of protection for payments to a BSB and account number. It checks the account name, BSB and account number you’ve entered against the details held by the recipient’s bank and lets you know whether it’s a match. This can help you make informed decisions before you make a payment, reducing the risk of scams and mistaken payments. Confirmation of Payee is an initiative of Australian Payments Plus, the same organisation that also provides trusted payment services like BPAY®, Osko®, eftpos®, PayID® and PayTo®.

When you make a payment to a BSB and account number, Confirmation of Payee checks the details you enter against the name, BSB and account number held by the recipient’s bank and gives you a match outcome. That helps you decide what you want to do next – and gives you more confidence that the money you’re paying is going to the right account.

Confirmation of Payee will check account details for all first-time or future-dated payments set up to a BSB and account number and when you make amendments to your online banking address book. Additional checks may be made depending on the financial institution.

'Account match' means the details you’ve entered match the bank records of the intended recipient. ‘Close match’ means the details you’ve entered closely match the bank records of the intended recipient. ‘No match’ means that the details you entered do not match the bank records of the intended recipient.

Yes. Confirmation of Payee will never stop you from completing a payment. We encourage you to be scam aware and always take steps to make sure you know who you are paying, as scams or mistaken payments may be difficult to retrieve.

If you enter the wrong account details, you can end up sending your money to the wrong recipient. This can be difficult and time-consuming to resolve, which is why it’s important to check the accuracy of the details you enter before you send your money.

Using CoP in online and mobile banking

You don’t need to do anything. Confirmation of Payee is already available in Online Banking and the MyCOAST Mobile Banking App. When you make a payment to a BSB and account number, or edit a payee’s BSB and account number, you’ll be shown a match result before the payment is processed. This check applies to new payees, as well as existing payees you haven’t paid in a while or whose account details have changed.

You don’t need to do anything. Confirmation of Payee is already available in Online Banking and the MyCOAST Mobile Banking App. When you make a payment to a BSB and account number, or edit a payee’s BSB and account number, you’ll be shown a match result before the payment is processed. This check applies to new payees, as well as existing payees you haven’t paid in a while or whose account details have changed.

No setup is required, it’s built in. Each time you add or update a payee’s BSB and account number, CoP will automatically run a check and return a result.

Yes. Confirmation of Payee won’t block your payments - the final decision is always yours. If something doesn’t look right, it’s a chance to pause and double-check with the person or business before you send money.

Privacy and Security

As part of the Confirmation of Payee service, Coastline Bank receives an electronic request from the financial institution of the person trying to pay you. We check that the BSB, account number, and account name entered by the payer match the details we have on record. Based on this, an electronic response of Match, Close Match, No Match, or Error is sent back to the payer. All Confirmation of Payee information is shared securely between financial institutions to keep your personal data safe.

As part of the Confirmation of Payee service, Coastline Bank receives an electronic request from the financial institution of the person trying to pay you. We check that the BSB, account number, and account name entered by the payer match the details we have on record. Based on this, an electronic response of Match, Close Match, No Match, or Error is sent back to the payer. All Confirmation of Payee information is shared securely between financial institutions to keep your personal data safe.

If you are receiving money into a personal account, the person who’s paying you will be shown the account name only if the name they have entered is a match or a close match. If any of these details are incorrect, the name will not be shown to protect your privacy. If you’re a business or government organisation account that’s receiving a payment, the name of your account will be shown to the payer, regardless of whether it’s a match or not.

Eligible customers may request to be opted-out of the Confirmation of Payee service. This means your account name and match outcome will not be displayed to payers and could impact the likelihood of the payer proceeding with the payment. To understand the opt out process and the implications, please contact each of your financial institutions including us on 1300 361 066.

Receiving Payments

If you want to get paid without any confusion or potential delays, you should share the name, BSB and account number for your bank account. This is especially important if you’re a business with an account name that differs from the name you’re using to take a payment; for instance, if you have a different trading name for a particular part of your business.

If you want to get paid without any confusion or potential delays, you should share the name, BSB and account number for your bank account. This is especially important if you’re a business with an account name that differs from the name you’re using to take a payment; for instance, if you have a different trading name for a particular part of your business.

To ensure your name is accurate in the Confirmation of Payee service, please contact each of your financial institutions including Coastline Bank on 1300 361 066.

Names and Special Cases

Names with special characters, like apostrophes (‘), will still match without being entered. For example, enter “O’Brien” as “O Brien” or “Obrien”. Or an account name with an ampersand (&) such as Paper & Pen can be entered as Paper Pen.

Names with special characters, like apostrophes (‘), will still match without being entered. For example, enter “O’Brien” as “O Brien” or “Obrien”. Or an account name with an ampersand (&) such as Paper & Pen can be entered as Paper Pen.

If the name you're trying to enter exceeds a character limit in your online banking, let the recipient know and consider how best to proceed by contacting Coastline Bank on 1300 361 066.

PayTo® – a new way to pay

PayTo® is a secure way to pay directly from your bank account, with more visibility and control. You can authorise, view, and manage your PayTo agreements anytime in the safety of your Coastline Online Banking or MyCOAST Mobile Banking App.

PayTo is provided by Australian Payments Plus, the team behind trusted services like BPAY®, Osko®, eftpos and PayID®.

Why use PayTo?

- Visibility & control – see and manage all your PayTo agreements in one secure place

- Secure payments – nothing leaves your account until you authorise it

- Real-time payments – funds move instantly, with no pending delays

- Flexible – works for one-off, ad hoc or recurring payments

PayTo by NPP

- A business offers PayTo at checkout or on your bill.

- You select PayTo as the payment option.

- You provide your PayID or BSB/account number.

- The PayTo agreement (amount, purpose, frequency) appears in your Online Banking or MyCOAST app.

- You review and authorise the agreement.

- Payments are made securely in real time, according to the agreement.

From your MyCOAST app or Online Banking you can:

- View all your agreements in one place

- See when payments will be debited and for how much

- Pause or cancel agreements anytime

- Resume paused agreements whenever you’re ready

- Direct debit: business-initiated, runs in the background, harder to manage.

- PayTo: customer-authorised, visible in your banking, easy to manage 24/7.

Any existing direct debits will continue as normal.

PayTo FAQs

PayTo is a secure way to make payments directly from your bank account. It gives you more visibility and control because agreements are authorised and managed within your banking.

PayTo is a secure way to make payments directly from your bank account. It gives you more visibility and control because agreements are authorised and managed within your banking.

Yes. PayTo agreements are protected by the same bank-grade security that already protects your accounts. You review and authorise each agreement before any money leaves your account.

PayTo is rolling out across many businesses and organisations. Look for the PayTo logo when paying bills, shopping online, or signing up for subscriptions.

An agreement between you and a business or service provider that sets out the payment terms (amount, frequency, purpose). You approve the agreement in your banking before payments begin.

Yes. You can pause, resume, or cancel agreements in your Online Banking or MyCOAST app. Cancelling doesn’t change your contract with the business – it just stops payments from your account.

If the agreement details don’t match what you expect, you can decline it and contact the business.

PayTo isn’t available for loans, term deposits, Budget Wise, Christmas Saver accounts, or any account requiring two or more signatures.

No. You can use either your PayID or your BSB/account number.

Coastline doesn’t charge to use PayTo. Businesses may apply their own service fees.

Osko® by NPP – fast, simple, secure payments

Osko® is a payment service from NPP Australia, designed to make sending and receiving money easy, secure, and nearly instant. Payments are processed 24/7, which means your money moves quickly – even outside business hours.

With Osko, you can pay friends, family, or businesses safely using just a PayID, BSB, and account number, without the wait of traditional transfers.

Why use Osko?

- Fast payments – money can arrive in seconds, any time, any day

- Secure transfers – protected by the same bank-grade security as your account

- Convenient – send money with just a PayID, BSB, or account number

- Always on – 24/7 payments, including weekends and public holidays

Osko by NPP

- Open Online Banking or the MyCOAST app.

- Choose Transfer to someone else.

- Enter the recipient’s PayID or BSB/account number.

- Confirm the payment.

- The recipient receives funds almost instantly, and you’ll get a confirmation.

From your MyCOAST app or Online Banking, you can:

- See recent Osko payments at a glance

- Set up recurring payments using PayID

- Track your outgoing and incoming payments in real time

- Traditional transfers: can take hours or days, especially outside business hours

- Osko payments: near-instant, available 24/7, and easier to track

Osko FAQs

Osko is a fast payment service built on the New Payments Platform (NPP) that allows you to send and receive money quickly using your PayID or BSB/account number.

Osko is a fast payment service built on the New Payments Platform (NPP) that allows you to send and receive money quickly using your PayID or BSB/account number.

Yes. Osko payments are protected by the same security systems that safeguard your bank account. Every transaction is verified and authorised by you.

Osko is available via participating financial institutions, including Coastline Bank.

Most payments arrive within seconds, even on weekends and public holidays.

No. You can use either a PayID or BSB/account number to send and receive payments.

Coastline Bank does not charge fees for Osko payments, though individual merchants or businesses may have their own charges.

Always double-check the PayID or BSB/account number before confirming. Incorrect details may delay or misdirect the payment.

No. Once an Osko payment is authorised and sent, it cannot be reversed. Contact the recipient directly if there’s an issue.

PayID® and PayTo® are registered trademarks of NPP Australia Limited ABN 68 601 428 737. | BPAY® and Osko® are registered trademarks of BPAY Pty Ltd ABN 69 079 137 518. | eftpos is a registered trademark of eftpos ABN 37 136 180 366