Our story

From humble beginnings to a trusted local bank

At Coastline Bank, our journey began with a simple yet powerful idea: to provide trusted financial services that support the people and communities of the Mid North Coast. Our roots are deeply embedded in the heart of this region, and for over 50 years, we've had the privilege of growing alongside our customers - helping them buy homes, build businesses, and plan for brighter futures. Today, we remain proudly customer-owned, regionally based, and committed to supporting the community.

Our Timeline

1960's - The beginning of a community dream

1966

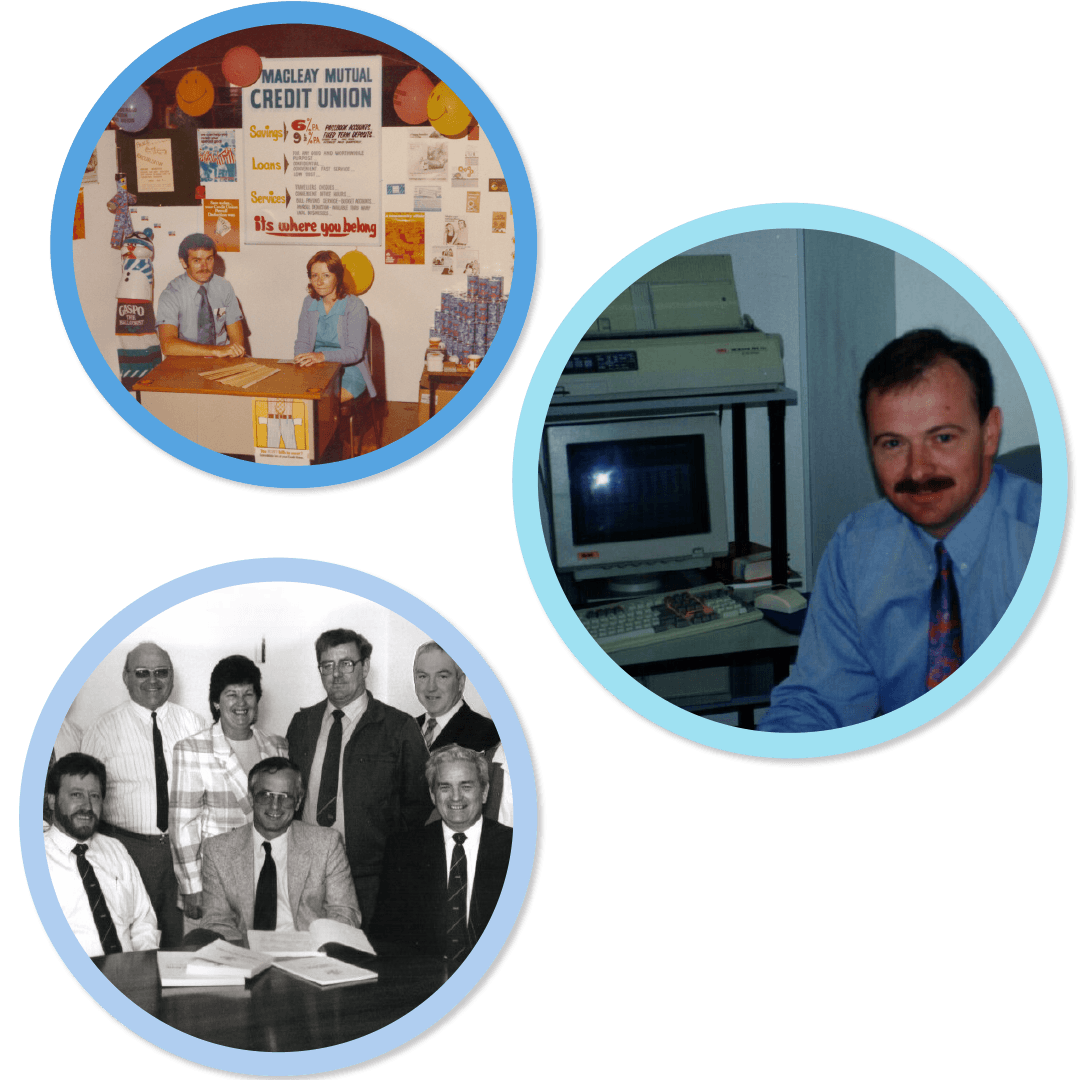

Our story began on 25 October 1966, when a small group of council employees gathered in the Macleay River County Council Chambers with a shared dream. From that meeting, the Macleay River County Council Employees Credit Union Ltd. was born - just 54 members strong, but full of heart.

Their goal was simple: to create a place where locals could save together and access fair, affordable loans. On 1 December that same year, we proudly approved our very first loan - $500 that helped plant the seeds of something much bigger.

1967

Our first full year was modest, but meaningful. We finished with a humble gross profit of just $21.82, a reflection of our commitment to people over profit. At the time, our loan interest rate was just 9 cents in the dollar - one of the lowest in all of New South Wales. And for our savers, we offered a generous 5% interest rate, helping locals make the most of every hard-earned dollar. It was a small beginning, but full of purpose and promise.

1969

Three years after we first opened our doors, the Credit Union welcomed new members from the local hospital, Macleay Co-op, and the Macleay Argus - a sign of our growing connection with the community. Around the same time, we changed our name to Macleay Mutual Credit Union Ltd., marking a shift towards a more inclusive, member-focused organisation.

1970's - Laying roots, expanding service and reach

1970

A new decade brought a new chapter. We officially became Macleay Mutual Credit Union, and Barry Martin stepped into the role of our first full-time Secretary Manager. With 285 members and $120,711 in assets, we were growing steadily - and with heart.

1973

We planted roots in the heart of Kempsey, purchasing our very first building at 39 Smith Street for $66,000. It was more than bricks and mortar - it was a home for our members.

1976

Our reach extended to the coast with the opening of our South West Rocks Branch, bringing our services closer to the community.

1979

Allan Algie became General Manager, taking over from Barry Martin. Under Barry’s leadership, membership had grown to 5,618 – a testament to the credit union’s strong community ties and growing relevance. This marked a new chapter, with Allan continuing to build on Barry’s solid foundation.

1980's - Growth through innovation, embracing new technologies

1980

By 1980, we’d come a long way. Our assets surpassed $6 million, membership neared 6,000, and our team grew to 17 staff. Our annual payroll crossed $200,000 - proof that we were not just growing, but thriving.

1982

A leap into the future - our first computer system was installed for $120,000. It could run up to 30 terminals and gave members access to real-time financial information. A game changer for the time.

1984

We officially opened our West Kempsey Branch and Administration Centre, with Kempsey Shire Council President Stuart McIntyre cutting the ribbon. It was a proud day for our team and our town.

1985

We purchased Mayfair Plaza, which became known as Credit Union Plaza - a bustling hub that further cemented our role at the heart of the local community.

1986

After serving faithfully, Allan Algie moved on to Uni Credit Union, and David Bevan took over as General Manager, ready to lead us into the next chapter.

1987

We celebrated 21 years of service. From just 40 founding members, we’d grown to 10,000 strong. That year, we introduced Member Chequing and partnered with Bridges Personal Investment Services to offer financial planning - supporting members through every stage of life.

1989

Our rules evolved, allowing us to lend to corporate members. We also opened our Credit Union Agency in Crescent Head, expanding our reach once again.

1990's - Strengthening connections, serving with heart

1990

Big changes arrived with the installation of our very first ATM on Smith Street, Kempsey. Redi-Access cards were introduced, giving members 24/7 access to their money. That same year, we sold the Credit Union Plaza - but stayed on as tenants, remaining part of the local fabric.

1995

We embraced a new identity - Coastline Credit Union - reflecting our growing footprint and commitment to delivering first-class financial services across the region. We extended our bond to include the Shire of Hastings and launched automated telephone banking for around-the-clock account access.

1996

Our Port Macquarie branch opened its doors, and we welcomed Peter Townsend as our new General Manager in October. As major banks pulled out of small towns, Coastline remained firmly committed to local service - fee-free and community-minded. We also changed wholesale banking providers and transitioned to Westpac for member chequing.

1998

We launched our Member Rewards Program, recognising those who supported our range of services. We also introduced loan redraw facilities and extended call centre hours - making it easier for members to get the help they needed.

1999

A proud achievement - Coastline was ranked in the top 10 Credit Unions in Australia for performance and efficiency by KPMG’s Annual Financial Institutions Performance Survey.

2000's - Expanding services, enhancing accessibility and convenience

2000

We celebrated a huge milestone - over $100 million in assets. Online Banking was introduced, opening new doors for members to manage their finances, anytime, anywhere.

2001

Severe flooding damaged Credit Union Plaza and three of our ATMs, but our West Kempsey Branch and ATM stayed above water, ensuring uninterrupted service. We also rolled out BPAY and enhanced our Online Banking.

In Port Macquarie, our branch moved to larger, more central premises on Horton Street.

2002

The Coastline Community Foundation was born - our way of giving back to the people and places that shaped us. We also opened a new branch in Taree, extending our services into the Manning Valley.

2005

Coastline became a Foundation Donor of the Slim Dusty Centre, honouring a local legend. That year, we also launched our eSaver account, offering high interest with free phone and Online Banking - simple, smart saving.

2006

Our brand-new South West Rocks Branch was officially opened by Philip Elliott, CEO of the National Credit Union Association. We also celebrated 40 years of service - four decades of community, trust, and local support.

2007

National recognition arrived when Money Magazine named our Business Access Account a finalist in their prestigious Best of the Best Awards for non-bank deposit accounts.

2008

In a year of global uncertainty, the Prime Minister introduced a guarantee scheme to protect all deposits held in Australian banks, credit unions, and building societies - including Coastline.

2009

We expanded ATM access, giving members fee-free use of more than 2,800 ATMs across Australia - including those operated by Westpac, St George, Bank SA, and BCU. Our Visa Rewarder Credit Card earned a 5-star rating from Canstar Cannex, and we launched eStatements for added convenience and sustainability.

2010's - Community commitment and digital transformation

2010

Over $420,000 in grants had been awarded through the Coastline Community Foundation - supporting schools, clubs, and causes across the region. We also relocated our Central Kempsey Branch to 65 Smith Street.

2011

We launched MyCOAST, our mobile banking app, giving members even greater control on the go.

2016

We proudly celebrated our 50th anniversary - half a century of standing beside our members and community. Port Macquarie branch moved to Settlement City, West Kempsey was renovated, and our Community Foundation had raised $850,000. By year’s end, we had 15,000 members, 50 dedicated staff, and $400 million in assets.

2020's - Rebranding, growth, and unwavering community focus

2020

A major milestone - our total lending reached $500 million. We simplified our name to Coastline, reflecting a modern brand while staying true to our values. We may have dropped “Credit Union” from our name, but our customer-first philosophy remains at the heart of everything we do.

2023

We proudly opened a new Agency in the charming town of Kendall - bringing Coastline’s personalised service to yet another local community. It was another step in our ongoing journey to stay close, accessible, and connected to the people we serve.

2025

In 2025, we proudly turned the page to a new chapter - becoming Coastline Bank. While our name may have changed, everything that matters has stayed the same. We’re still customer-owned, still local, and still here for the people of the Mid North Coast - just as we’ve always been.

This moment reflects how far we’ve come and the exciting road ahead. Today, we’re honoured to support more than 20,000 customers. Through our Community Foundation, we’ve raised over $2.5 million for local groups and causes, and our team has lovingly dedicated more than 1,400 volunteer hours to the communities we call home.

We may look a little different, but our heart is still right where it’s always been - with you.

Customer-first, always

We’re not driven by shareholders - we’re driven by you. Every step of our journey has been about supporting our customers, from the first $500 loan to today’s wide range of banking services. Whether you're banking with us online, over the phone, or in person, we’re committed to providing a warm, helpful experience every time.

As we look to the future, we’ll continue to expand our services and adapt to meet the needs of our customers. Whether it’s providing fee-free services or innovative financial products, we’re always here to support you.

A financial institution you can rely on

In times of change, we’ve remained a stable and reliable partner for individuals, families, and local industries. We’ve weathered economic storms, supported our members through adversity, and always kept our focus on long-term, sustainable financial health.

Our future as Coastline Bank

In 2025, Coastline Credit Union officially transitioned to Coastline Bank - a fresh new name that reflects our evolution, ambition, and commitment to modern, community-first banking. What won’t change is our core values: being customer-owned, community-focused, and always here for you. As we look to the future, we’re excited for the next chapter of our journey with you by our side.