Latest News

19 March 2023

Customer-owned banking institutions are well known for supporting their members and giving back to communities, but new research means we can now put dollar figures on the impact we have on local regions and the country in general.

As our customers know, customer-centric banking institutions do things differently to their counterparts. With your interests guiding our decision-making, credit unions, mutuals and building societies support communities, provide employment across the country and invest in initiatives to better the planet.

These values run deep within the sector, so the Customer Owned Banking Association (COBA) thought it was important to further quantify the impact that customer-owned banks have on the communities they serve. To that end, COBA engaged accounting firm KPMG to measure what customer-owned banks contribute to their local communities. Almost three-quarters of the customer-owned banking industry participated in the research, representing a broad spectrum of the sector.

Here are just a few things the report found, which may be worth sharing.

- One-in-five Australians banks with a customer-owned institution

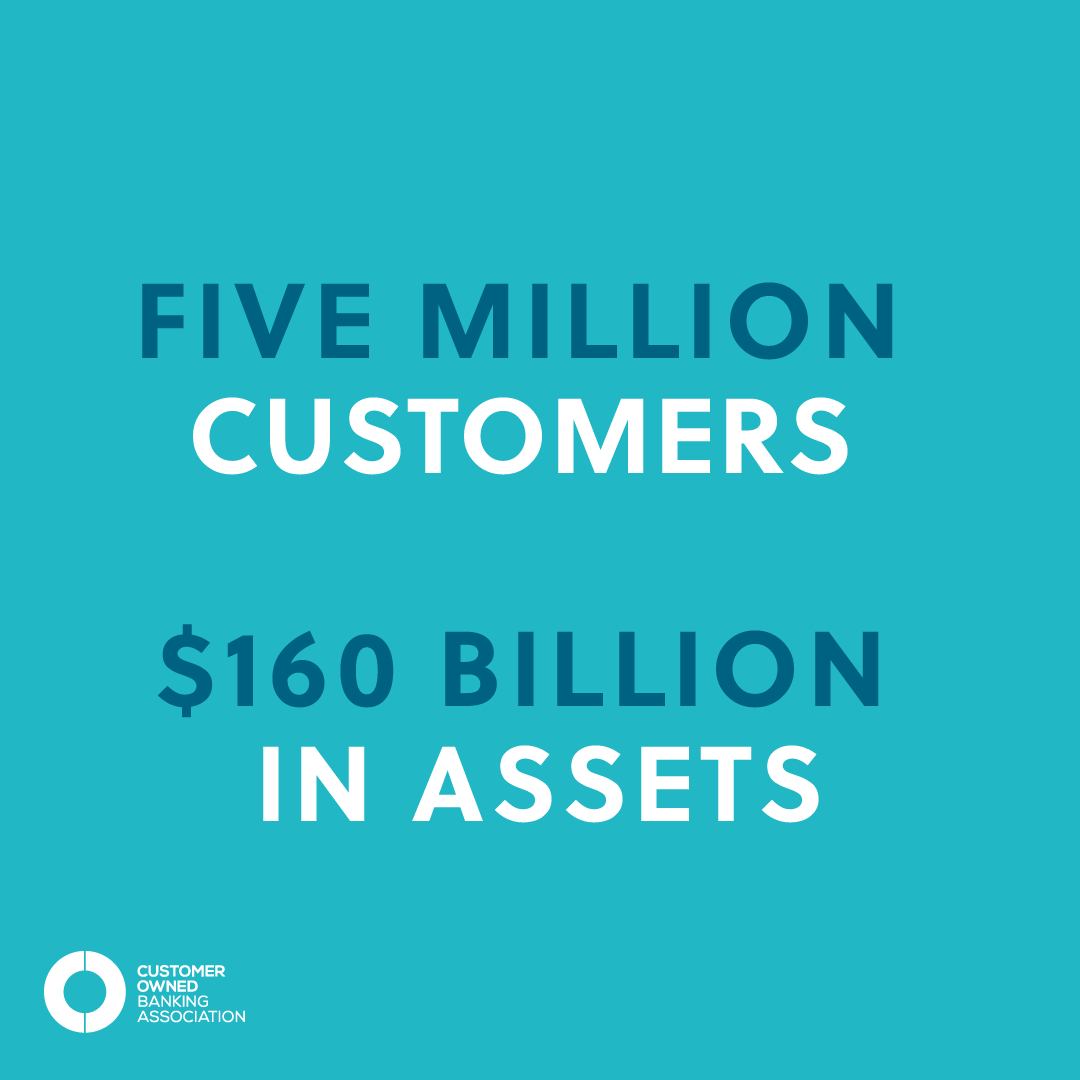

With 5 million members, the customer-owned banking network serves about one-in-five Australians. In other words, everyone knows someone who has their savings or loan products with one of our institutions.

The 61 customer-owned banking institutions represent 70 per cent of Australia’s total and collectively hold $158.8 billion in assets, as at the end of FY22.

- The customer ownership model delivers better service and pricing

As both customers and shareholders, members receive better products, service and pricing, and don’t pay dividends to external shareholders.

For instance, the report found that customer ownership translates into an implicit lending rate subsidy to members. KPMG estimates this subsidy to members is equivalent to a 0.3 percent discount to the market interest rate – which equates to more than $1,500 in interest annually on a $500,000 mortgage.

The sector’s focus on helping members own the home they live in results in a mortgage lending market share of more than 5.5%, above-system growth, and a higher proportion of lending to owner-occupiers and first-home buyers.

- Customer-owned banks have invested in staff and branches, especially in regional areas

Amid the digital revolution, customer-owned institutions have hired more Australians to support their members. In fact, the pace of jobs growth in the customer-owned banking sector last financial year outstripped that of the major banks.

Employment in the sector grew by 4.4 per cent between FY21 and FY22, with 11,200 full-time equivalent jobs at customer-owned banking institutions at the end of the most recent financial year, earning a combined $1.24 billion in wages.

By comparison, as the major banks have been under shareholder pressure to reduce costs, they grew employment at a slower rate – 2.4%.

KPMG found that the customer ownership model translates into additional job creation, equal to about 5 per cent of sector employment.

In particular, the sector is an unrivalled provider of highly skilled jobs in financial services in regional locations. With 720 branches throughout Australia, the sector operates 18% of total branches and more than one-in-five in regional areas.

In fact, due to the sector’s Australia-wide footprint, it provides many skilled jobs in regional locations, with 52% of staff working and living outside metropolitan areas.

- We give a lot back to charities and communities

Customer-owned banks talk a lot about supporting their communities – and the numbers certainly back up the claims. The KPMG report found the sector distributes around $6 per member per year to charitable organisations and community sponsorships.

With a membership of around five million, this is equivalent to $30 million injected directly into the community. This compares favourably to the four major banks – analysis suggests their financial community contributions are only around $2 per customer on average.

At the same time, customer-owned banking staff are heavily engaged with local communities through paid volunteering, which is estimated to add up to around $13,000 per institution.

- Customer-owned banks also contribute heavily to Australia’s economic growth

In addition to helping local communities thrive, customer-owned banks also support the greater Australian economy. Collectively, the sector contributes about $2 billion to the country’s GDP, the report found, when considering wages, profits and taxes.

This is a larger direct economic contribution than that of aquaculture, fishing, forestry, gas supply services, shipping or petroleum and coal product manufacturing.

The sector’s wider economic footprint is even larger. When taking into account other factors, such as non-wage expenditure and planned investments, KPMG estimates customer-owned banking’s economic impact is equal to $5.7 billion.

For many customer owned banks, the above statistics offer a reminder of what we already know: customer-owned banking institutions invest in communities, put people before profits and have a large and growing footprint in Australia.